Shipping container investment: Make easy profits with our guide [2025]

![Shipping container investment: Make easy profits with our guide [2025] - image №29](https://pelicancontainers.com/wp-content/uploads/2022/08/1659647944410_.jpg.webp)

🎧 Listen while you read – this episode covers investing in shipping containers and maximizing profits.

Shipping containers are usually a wise investment since they have both material and functional value. So, how should you begin to invest in containers? This article will show you how to do it in many different ways, targeting markets in both North America and across the globe.

How Shipping Container Investment Works

Shipping container investment isn’t the most obvious choice. However, with the need for international commerce on the rise, it has quickly become a popular method to make money.

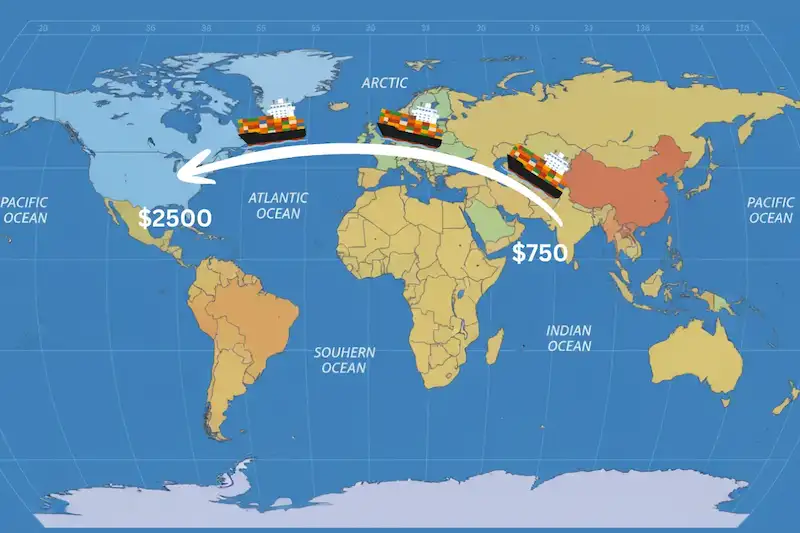

Imagine you find a location with an extra supply of shipping containers (they may be sitting idle in certain parts of the world) and decide to purchase them at a discount. Then, you sell that same container at a higher price in a location where there’s a shortage. For instance, you may pay $760 (€720) for a container in India and sell it in the United States for around $2,500 (€2,370). When you know where the demand is high, you make a lot of money.

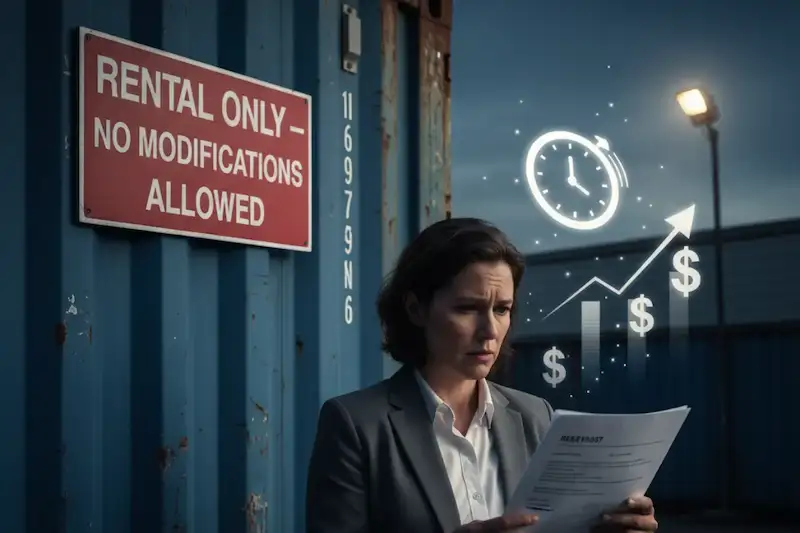

You can also try leasing if you want a passive revenue stream that doesn’t fluctuate much. It works like this: you rent the container to shipping companies, who use it to transport products overseas. If you want a hands-off approach, this method is excellent as it does not call for continuous buying and selling. Besides, you keep earning as long as your container is in excellent condition. (Read more in our guide to container rentals).

The repositioning and selling option combines leasing and selling. You purchase an inexpensive container, lease it out for a trip to a place where containers are limited, then sell it at the new site for a good profit. You may, for example, purchase a container meant for India, lease it for use in China, and then sell it for more once it gets there.

Different Types of Containers for Investment

There are several popular types of containers for investment. Knowing the variety helps you diversify:

-

Standard containers (20, 40, and 45 feet): They handle most of the world’s trade goods, like clothes and electronics. Standard containers come in three main sizes: 20ft containers for heavy dense cargoes, 40ft containers for general freight, and 45ft containers for bulky goods.

-

High cube containers: Since High Cubes are a foot (30 cm) taller than standard containers, they accommodate bigger or taller objects like equipment or furniture.

-

Open top containers: Heavy machinery or building supplies, for example, may not fit in standard containers due to their height; these containers, with their detachable roofs, are an ideal solution.

-

Open side containers: These are perfect for carrying oversized objects like pipes or long slabs of wood, as the side panels open completely.

-

Tunnel containers (double-door): These containers have doors on both ends. They speed up and simplify loading and unloading, especially if you require access from multiple spots.

-

Flat rack containers: These are used for transporting huge items like automobiles, industrial equipment, or heavy gear since they either have collapsible sides or none at all.

-

Refrigerated (reefer) containers: These include built-in cooling mechanisms to maintain their contents’ designated temperature, crucial for food and pharma.

Unique shipping container uses open doors to different markets. They also imply more freedom in terms of leasing, selling, or repositioning them.

Benefits of Shipping Container Investments

Here are some of the best reasons to invest in shipping containers:

-

Tangible Value: Shipping containers are hard assets having both functional and material worth. As long as they are in good shape, you will always be able to sell or lease them.

-

Consistent Income: Buying, selling, and leasing out containers guarantees a consistent flow of money. There are two certain ways to generate stable income: either by buying containers and reselling them at a profit or by leasing them out.

-

Growing Market: An ever-expanding sector, shipping in containers now carries 70% of global trade value and 80% of world trade volume. Isn’t it usually a good idea to invest in a resource that is essential to a developing industry?

-

Necessity: Containers are a must for international commerce, so you may profit from them as long as the shipping container business runs.

-

Longevity: Durable and reusable, shipping containers have a potential lifespan of 25 years. If you’re thinking about leasing containers for a long time, the ROI will be enormous.

Risks to Consider in Shipping Container Investment

There is always a degree of risk when making any investment, and you should know about it before jumping in. Regarding shipping containers, bear these risks in mind:

-

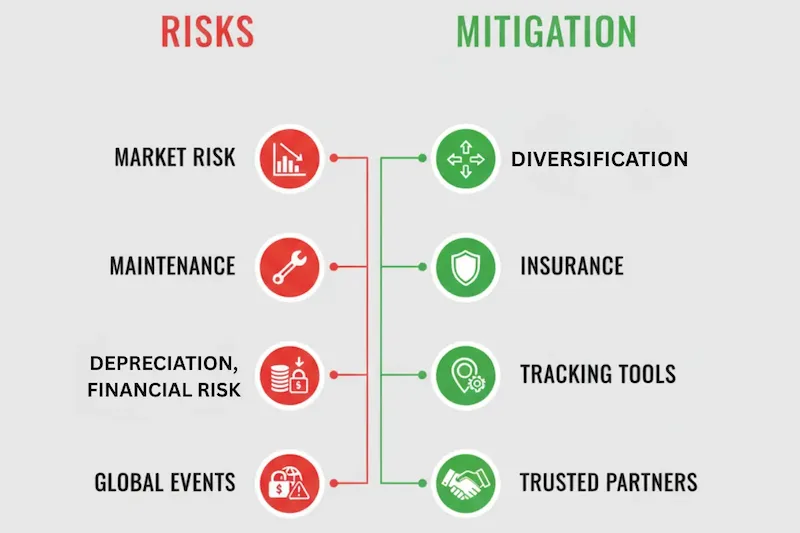

Market Risks: Prices are continually shifting, hence over time changes in market risk may influence your return on investment (ROI), particularly if your sales fall at the wrong moment.

-

How to mitigate? Consistently track regional demand and market changes using trusted data sources.

-

-

Maintenance, Mishaps, and Loss: At sea, containers may sustain damage and even disappear.

-

How to mitigate? Get container insurance always to guard your investment from harm or loss. Working with trustworthy partners or lessees will help you reduce misuse-related problems.

-

-

Shipping Container Depreciation Life: Though they are in demand, containers nonetheless lose value over time. Especially if they sustain damage or need several repairs throughout the years.

-

How to mitigate? Select durable, in-demand containers — such as standard or reefers — then make sure they are well maintained. The best time to sell or lease containers is during their peak value window.

-

-

Financial Risks: There is a chance that you and your company can lose money if unreliable lessees or purchasers don’t pay their bills.

-

How to mitigate? Work with reliable vendors or safe online marketplaces with built-in verification and payment protection features.

-

-

Lack of Tenants or Buyers: Depending on the state of the economy, there may be an oversupply of containers or a shortage of demand, and this can lead to your assets sitting idle, generating no income.

-

How to mitigate? Have a variety of containers (standard, high cube, reefer, etc.) to cater to different container stocks.

-

-

Global Events and Disruptions: Global occurrences like shifts in trade regulations, natural catastrophes, or geopolitical unrest cause disruptions in the shipping container business, affecting container demand and utilization.

-

How to mitigate? Keep current with world events and vary your investing plans. You shouldn’t stay totally dependent on one market or tactic.

-

You may lessen the blow of potential losses on your shipping container investment by adopting a proactive mentality. Just invest in research, use reliable platforms, insure your containers, and monitor market movements closely. You won’t just mitigate risks — you’ll boost your earnings this way.

How to Maximize Profits in Container Investments

There are some tried-and-true ways to maximize your container investments:

-

-

Do your market research. Different areas have different needs for containers, hence costs depend on trade trends, season, and location. In a high-supply location like India, for example, a container costs much less; however, in Europe or the United States, where there’s a great demand, it would fetch far more. Track changing shipping patterns to determine where to lease, purchase, or sell your containers.

-

Diversify your container portfolio. Not all containers are made equally; hence, diversification lowers risks and increases income sources. For example, standard containers are flexible and constantly in demand. Reefer units attract more rental revenue since they are designed for unique items like food or medications. Often with better margins, Open Top and Flat Rack containers serve specialized sectors, such as construction. Owning a range of different containers will help you satisfy different customers and guarantee a consistent revenue, even if one market slows down.

-

Stay adaptable to market needs. The container business is a dynamic industry, and today’s profitability may change tomorrow depending on world trade patterns. For instance, strong demand for standard containers might raise their rental values up. So, adapt to these shifts and stay nimble. Should reefers be in demand this season, pay special attention to them.

-

Leverage technology. Technology is your best friend when it comes to managing your container investments. Use specialized platforms to connect with global buyers, sellers, and shippers. These platforms also provide information on price patterns, monitor market demand, and even manage documentation. Also, try using tracking tools to monitor container locations and conditions.

-

Build strong partnerships. They will make or break your investments, so choose reliable shipping companies and leasing platforms. For example, working with a trustworthy shipping provider, such as Pelican Containers, reduces the possibility of damage or mismanagement.

-

Keep maintenance costs under control. Well-maintained containers fetch higher leasing rates and resale value. Frequent inspections looking for corrosion, dents, or damaged seals and monitoring shipping container depreciation life help to avoid little issues becoming large ones. Moreover, keeping a solid record of your container’s state will increase its attractiveness to future buyers. (See our guide on how to maintain shipping containers).

-

Choose high-demand locations. How much money you earn is highly dependent on where you are located. Selling or leasing containers in areas of great demand promises increased profits. For instance, global industrial bins located close to major ports in Europe or North America often command higher rental rates.

-

Insure your containers. Accidents happen, and without appropriate insurance, these hazards — from a container loss at sea to one stuck during shipment — can chew on your income. While your cargo is on the move, container insurance will guard you from unanticipated expenses.

-

Monitor industry trends. The more informed you are about the container business, the better your profits will be. Pay close attention to global trade changes like new free trade agreements or rising e-commerce activity, as these may lead to surges in container demand.

-

Sell strategically. Knowing where to sell will help you, whether your goals are resale profits or leasing revenue. Reselling containers at the end of their peak usage or during strong demand guarantees you are optimizing returns. Avoid holding onto containers for too long; once they start depreciating heavily, sell them off.

So, if you want to get the most out of your investments in shipping containers, you need to be well-informed, proactive, and smart. Constant market monitoring and patience will help your containers become gold mines.

-

Shipping Container Investment vs. Traditional Investments

There are different options to grow your money, but they have certain appeals and risks. We’ve created this table to help you weigh the options.

| Aspect | Shipping containers | Stocks | Bonds | Real estate |

| Risk level | Moderate. Risks include market fluctuations, maintenance costs, and potential damage. However, it is manageable with research and diversification. | High. Highly volatile and subject to market performance. Prices rise or plummet quickly based on external events. | Low. Stable and predictable, but with modest returns. Risks tied to the issuer’s creditworthiness. | Moderate. Risks include economic downturns, property damage, and difficulty finding tenancy. |

| Return potential | High, especially for leasing specialized containers like reefers and selling in high-demand areas. Returns depend on container type and global container stocks. | Very high. Potential for significant gains with high-performing stocks, but also major losses. | Low to moderate, Consistent returns, better for stability than high growth. | High (long-term). Rental income provides regular cash flow, with potential property appreciation over time. |

| Market volatility | Moderate. Influenced by global trade trends, economic cycles, or events like a pandemic. | Very high. Stocks rise and fall daily based on news, reports, or unpredictable factors. | Low. Bonds are more stable and more predictable based on interest rates. | Moderate. Values change slowly, but recessions cause downturns. Cyclical trends are common. |

| Liquidity | Moderate. Selling containers can be quick, but leasing ties them up for months or years. | High. Stocks can be bought and sold almost instantly. | Moderate. Bonds can be sold before maturity, but they depend on market demand. | Low. Selling property takes weeks or months, so it is one of the least liquid investments. |

| Initial investment | Low. Entry starts at a few thousand dollars. | Low. Starts with as little as $100 or less with fractional shares. | Moderate. Starts around $1,000. | High. Down payments, maintenance, and taxes require tens of thousands upfront. |

Shipping container investments occupy a unique sweet spot between stocks’ high-risk, high-reward nature and bonds’ steady but modest returns.

Future Outlook for Shipping Container Investment in 2025

Shipping container investments are poised to remain a dynamic opportunity for investors heading into 2025.

Some trends to watch include:

-

Global trade recovery and growth after recent disruptions (e-commerce will expand across borders, and global industrial bins will likely remain in high demand).

-

Technological advancements (shipping in containers equipped with Internet of Things devices, real-time location tracking, temperature monitoring, and theft prevention).

-

Sustainability and circular economy (containers made from recycled materials will create new revenue streams).

However, there will be some challenges to navigate:

-

Economic uncertainty (the possibility of economic recessions or inflationary pressures).

-

Regulation changes (especially regarding environmental impacts and carbon footprints).

-

Competition is driven by the growing popularity of shipping container investments.

There are also some opportunities on the horizon:

-

Repurposing old containers for construction projects and tiny homes is expected to grow.

-

The rise of flexible workspaces and container moving and storage needs will fuel demand for container rentals.

-

New regions will emerge as logistics hubs, creating fresh markets for repositioning.

Vanessa is a dedicated writer and content enthusiast at Pelican Containers. With a background in practical writing and a keen eye for clarity, she transforms complex container topics into easy-to-understand and useful content. Her passion lies in exploring the evolving world of container usage — from smart storage hacks to global logistics trends.

When she's not writing, Vanessa loves discovering creative shipping container projects or traveling to find new inspiration.

Explore thoughtful, informative, and accessible content with Vanessa!

Vanessa is a dedicated writer and content enthusiast at Pelican Containers. With a background in practical writing and a keen eye for clarity, she transforms complex container topics into easy-to-understand and useful content. Her passion lies in exploring the evolving world of container usage — from smart storage hacks to global logistics trends.

When she's not writing, Vanessa loves discovering creative shipping container projects or traveling to find new inspiration.

Explore thoughtful, informative, and accessible content with Vanessa!

FAQ

How does shipping container investment generate profits?

Shipping containers generate profits mostly through resale and leasing. When you lease containers, businesses pay you to use them for transporting goods. You can also sell containers to other investors or companies when their market value increases, such as during times of high demand in global trade.

What are the different types of containers available for investment?

The different types of shipping containers available for investment include standard (20ft, 40ft, 45ft), high cube, open top, open side, flat rack, double-door (tunnel), and reefers.

What are the main risks involved in shipping container investment?

The main risks involved in shipping container investment include market fluctuations, maintenance & damage costs, economic cycles, and container moving and storage expenses.

What strategies can maximize returns in shipping container investments?

To maximize returns in shipping container investment, consider market research, diversification, using technology, and building strong partnerships with trusted suppliers like Pelican Containers.

![Port of Nhava Sheva: Keys to success, container terminals, and future prospects Shipping container investment: Make easy profits with our guide [2025] - image №52](https://pelicancontainers.com/wp-content/themes/pelican-wp/img/holder.png)